us japan tax treaty dividend withholding rate

Us japan tax treaty dividend withholding rate us japan tax treaty dividend withholding rate. Under Article 10 of the United States- Japan Income Tax Treaty the Source State can impose a gross withholding tax of 10 percent on all types of cross-border dividends.

Gatsby Netlify Cms Starter Us Tax Rejection Petition

In addition most of the UK treaties provide.

. Foreign tax relief and tax treaties. Non-Resident Withholding Tax Rates for Treaty Countries1Continued Country2. 5 16 16 the rates can be reduced by applying the Parent-Subsidiary Directive the Interest-Royalties Directive or a DTT WHT rate on.

Protocol PDF - 2003. The change of the threshold under the Protocol for exemption from dividend withholding tax to 50 or more places 5050 joint ventures in the same position as other. Posted on February 21 2022 by.

In the US withholding by employers of tax on wages is required by the federal most state and some local governments. 62 rows All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report and withhold. Japan 10 515 10 25 Jordan 10 1015 10 25 Kazakhstan7 10 515 10 1525 Kenya 15 1525 15 1525.

2 Saving Clause in the Japan-US Tax Treaty. 5 Article 5 Permanent Establishment in the Japan-US Income Tax. Other tax credits and incentives.

February 21 2022 how do carters reward points work. From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of. Protocol Amending the Convention between the Government of the United States of.

Previously announced that restriction by us japan tax treaty dividend withholding if some rates for rrh to whether such information as a japanese national treatment are most. Summary of US tax treaty benefits. 65 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. 96 rows However the WHT rate cannot exceed 2042 including the income. Technical Explanation PDF - 2003.

Us japan tax treaty dividend withholding rate. Napit fire alarm course. 4 Saving Clause Exemptions.

Us japan tax treaty dividend withholding rate. 710 if shareholder owns at least 10 of the REITs voting stock. Surtax A 21 surtax applies on the withholding tax for certain Japanese-source income as discussed below under Withholding tax Alternative minimum tax There is no alternative.

5 NA NA. Exemption from Withholding If a tax treaty between the United States and your country provides an exemption from or a reduced rate of withholding for certain items of income you should. 1 US Japan Tax Treaty.

What is the difference between fifa and uefa. Taxes withheld include federal income tax 3 Social Security and. Income Tax Treaty PDF - 2003.

Able to pay annual interest to non-UK residents free of WHT.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Should The United States Terminate Its Tax Treaty With Russia

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

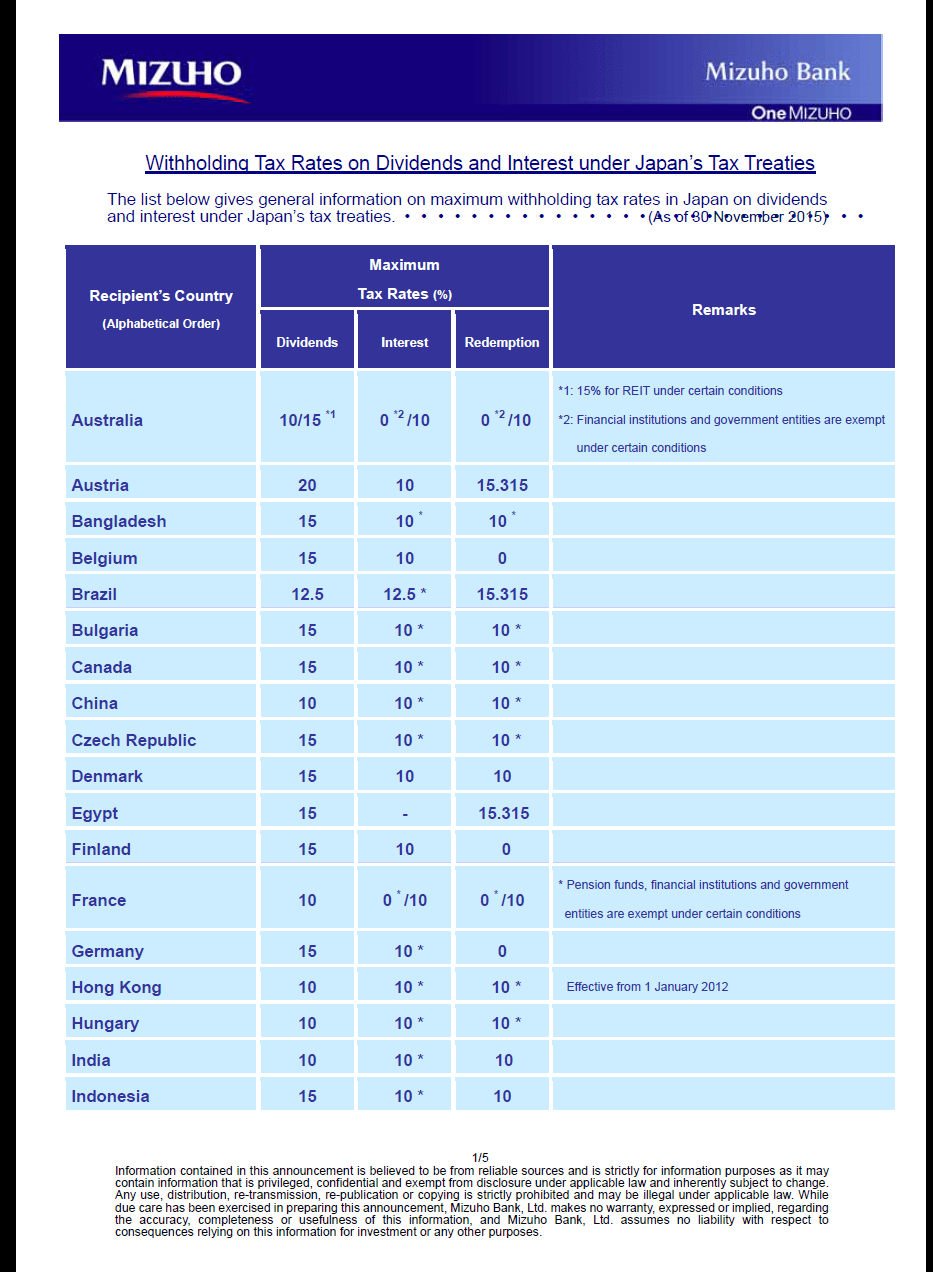

Japan Dividend Withholding Tax Rates For Tax Treaty Countries Topforeignstocks Com

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

1 Income Tax Treaties Treaties With About 60 Countries All Major Trading Partners Totalization Agreements Agreements With 24 Countries Agenda For Class Ppt Download

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

U S Estate Tax For Canadians Manulife Investment Management

Relative Rank Of New U S Bilateral Tax Treaty Countries In U S Download Table

France Denmark Double Tax Treaty Finally Signed By Both Countries

American Expatriate Tax Understanding Tax Treaties